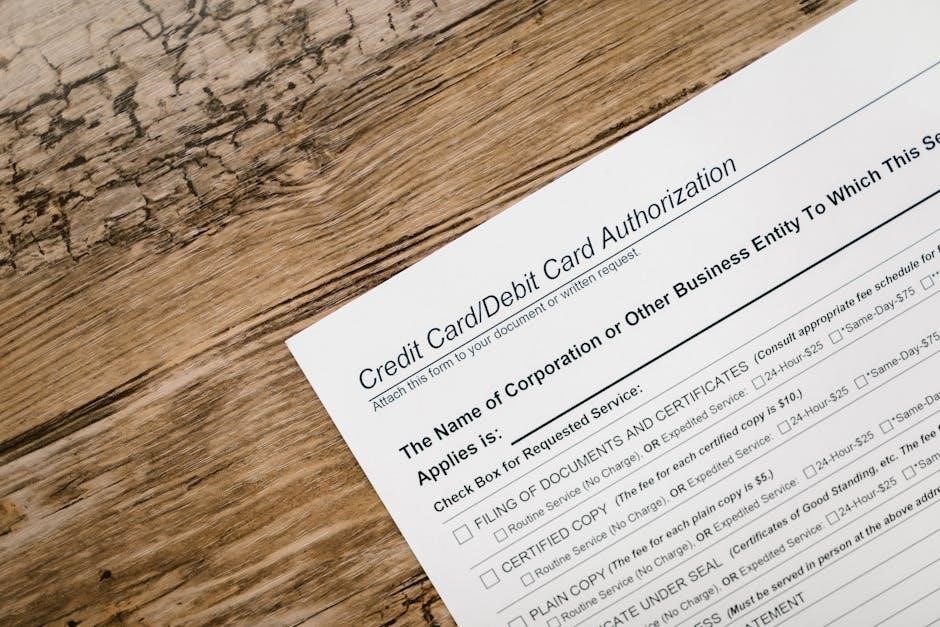

A Business-to-Business (B2B) Credit Application Form is a document used by businesses to request credit from suppliers or financial institutions. It collects essential information about the business’s financial history, ownership, and creditworthiness to evaluate its eligibility for credit.

1.1 Definition and Purpose

A Business-to-Business (B2B) Credit Application Form is a document used by businesses to request credit from suppliers, lenders, or financial institutions. It serves as a formal request for credit facilities, enabling businesses to purchase goods or services on credit. The form collects essential details about the business, such as its name, ownership structure, financial history, and references. Its primary purpose is to provide lenders with the necessary information to assess the business’s creditworthiness and make informed decisions about extending credit. This process helps establish a trusted financial relationship between the business and the creditor.

1.2 Importance in B2B Transactions

A Business-to-Business (B2B) Credit Application Form plays a crucial role in facilitating smooth transactions between businesses. It helps suppliers assess a company’s creditworthiness, enabling them to offer tailored payment terms and build trust. By providing detailed financial insights, the form ensures informed credit decisions, reducing risks for both parties. For businesses, it simplifies cash flow management and strengthens supplier relationships. Additionally, it establishes clear payment expectations, preventing potential disputes. Overall, the form is essential for maintaining efficient and secure B2B transactions, ensuring compliance with financial regulations and fostering long-term partnerships.

1.3 Overview of the Application Process

The business credit application process involves submitting a detailed form to a lender or supplier. Businesses provide information about their financial history, ownership, and credit references. The form is reviewed to assess creditworthiness and determine eligibility for credit. Once submitted, the lender evaluates the application, often requiring additional documentation like financial statements. Approval or denial follows, with terms outlined if approved. This process ensures both parties understand their obligations, facilitating trust and smooth transactions. It also helps businesses manage cash flow and suppliers maintain secure, reliable partnerships. The process is foundational for building lasting B2B relationships.

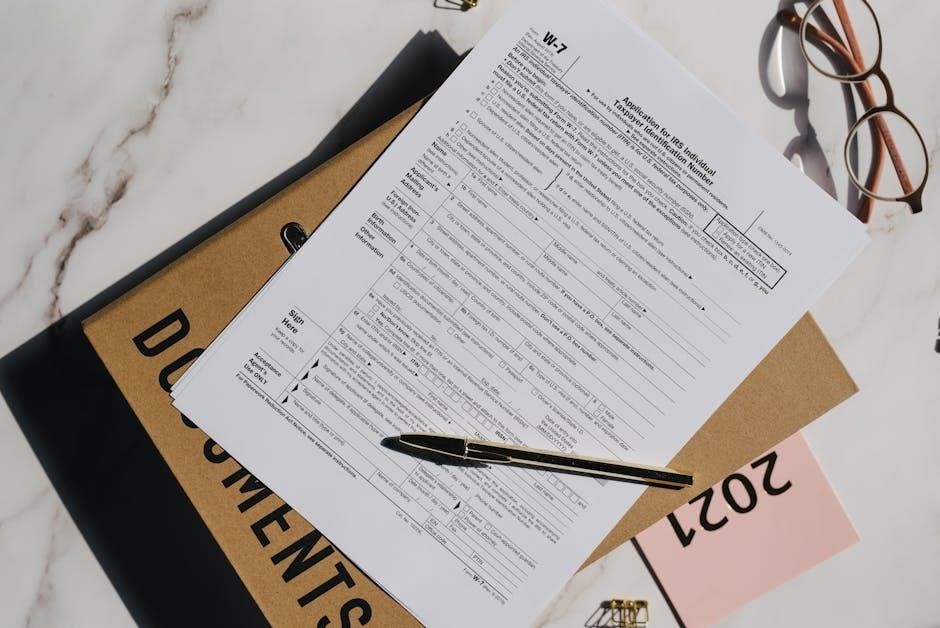

Key Elements of a Business Credit Application Form

A business credit application form typically includes sections for business information, financial details, and credit history. These elements help lenders assess the company’s creditworthiness and make informed decisions.

2.1 Business Information Section

The Business Information Section requires details such as the company name, structure (e.g., LLC, corporation), ownership information, and principal officers. This section also includes the business address, contact details, and industry type. Additionally, it may ask for the company’s tax ID number and registration details. This information helps verify the business’s identity and legal standing. Accurate and complete data in this section is crucial for lenders to assess the company’s credibility and make informed credit decisions. Missing or incorrect information can delay the approval process or lead to rejection. Ensuring clarity and precision is essential for a smooth evaluation.

2.2 Financial Information Requirements

The Financial Information Section is critical for assessing a business’s creditworthiness. It typically requires detailed financial statements, including balance sheets, income statements, and cash flow analyses. Additionally, lenders may request historical financial data, such as revenue trends and profit margins. This section may also ask for information on outstanding debts, payment practices, and credit history. Providing accurate and up-to-date financial records helps lenders evaluate the business’s stability and ability to repay credit. Incomplete or inaccurate financial data can lead to delays or rejection of the credit application. Ensuring transparency in this section is vital for building trust with creditors.

2.3 Credit History and References

The Credit History and References section is essential for evaluating a business’s reliability. It typically includes details about past credit experiences, such as payment history and any defaults. Businesses may be required to provide references from other creditors, suppliers, or financial institutions; A positive credit history demonstrates trustworthiness, while negative marks can raise concerns. Lenders use this information to assess the risk of extending credit. Providing accurate and verifiable references is crucial, as discrepancies can lead to application rejection. This section helps build credibility and ensures lenders have a comprehensive understanding of the business’s financial behavior.

The Process of Completing a Business Credit Application

Completing a business credit application involves gathering necessary documents, accurately filling out the form, and submitting it for review. This streamlined process ensures efficient evaluation and decision-making.

3.1 Gathering Necessary Documentation

Gathering necessary documentation is the first step in completing a business credit application. This includes the business registration, financial statements, tax returns, and bank statements. Additionally, references from other creditors or suppliers may be required to verify the company’s credit history. Ensuring all documents are up-to-date and accurate is crucial for a smooth application process. This step helps lenders assess the business’s financial health and creditworthiness, making it essential to organize all required paperwork beforehand. Proper documentation ensures the application is complete and ready for review.

3.2 Filling Out the Form Accurately

Filling out the business credit application form accurately is critical to avoid delays or rejection. Ensure all fields are completed with precise information, including business name, ownership details, and financial data. Double-checking the accuracy of provided information, such as revenue figures and credit references, is essential. Any errors or omissions can lead to misunderstandings or denial of credit. It’s important to be transparent and thorough, as lenders rely on this data to assess creditworthiness. Taking the time to carefully complete each section ensures a smooth and efficient application process.

3.3 Submitting the Application

Once the business credit application form is completed, it must be submitted to the appropriate institution or supplier. Ensure all required documentation, such as financial statements and references, is included to avoid delays. Many businesses now offer online submission options, while others may require mailing or in-person delivery. Double-checking the form for accuracy before submission is crucial, as errors can lead to processing issues. After submitting, follow up with the lender to confirm receipt and inquire about the timeline for review. A smooth submission process helps maintain a positive relationship and ensures timely credit decisions.

Evaluating a Business Credit Application

Evaluating a business credit application involves analyzing the provided information to determine the business’s creditworthiness and make informed decisions about extending credit.

4.1 Assessing Creditworthiness

Assessing creditworthiness involves evaluating a business’s ability to repay debts; This includes reviewing financial statements, credit history, and payment patterns to determine risk levels. Lenders analyze revenue, expenses, and debt-to-equity ratios to gauge financial stability. A strong credit score and positive references enhance credibility. Additionally, industry benchmarks and market conditions are considered to ensure the business can meet obligations. A thorough assessment helps lenders decide whether to approve credit and under what terms. This step is critical for minimizing risks and ensuring mutually beneficial B2B credit relationships.

4.2 Reviewing Financial Statements

Reviewing financial statements is a critical step in evaluating a business’s creditworthiness. Lenders typically examine the balance sheet, income statement, and cash flow statement to assess the company’s financial health; The balance sheet provides insights into assets, liabilities, and equity, while the income statement reveals revenue and expenses. Cash flow statements show how cash is generated and used. By analyzing these documents, lenders can evaluate the business’s profitability, liquidity, and debt levels. This review helps determine whether the business can manage credit responsibly and meet repayment obligations, ensuring informed decision-making in the credit approval process.

4.3 Verifying References and Information

Verifying references and information is essential to ensure the accuracy of the data provided in a business credit application. Lenders typically contact the listed references, such as bank references and trade references, to confirm the business’s financial stability and credit history. Additionally, they may cross-reference the information with public records and credit bureaus. This step helps mitigate risks by identifying any discrepancies or inaccuracies in the application. Accurate verification ensures that the credit decision is based on reliable data, fostering trust and accountability in the B2B credit relationship. It also protects both parties from potential fraud or misrepresentation.

Business Credit Application Templates and Tools

Business credit application templates and tools simplify the process of creating and managing credit requests. Downloadable templates, online platforms, and customization options are widely available to streamline applications and ensure accuracy.

5.1 Downloadable Templates

Downloadable business credit application templates provide a convenient starting point for creating professional forms. Available in formats like Word, PDF, and Excel, these templates are customizable to suit specific business needs. They often include sections for company details, financial information, and credit history, ensuring a comprehensive application process. Many templates are free or low-cost, offering flexibility for businesses of all sizes. Popular platforms like Microsoft Office and specialized websites offer a variety of designs, making it easy to find a template that aligns with your brand and industry requirements. This saves time and ensures a polished, professional appearance.

5.2 Online Application Platforms

Online business credit application platforms streamline the process of requesting credit, offering a digital solution for businesses. These platforms provide user-friendly interfaces where companies can submit applications, upload documents, and track their status in real-time. Many platforms integrate with accounting software and CRM systems, ensuring seamless data flow. They also offer features like automated credit checks, customizable forms, and secure data storage. Popular platforms include Trade Assurance, CreditPoint, and others, which cater to various industries. By reducing paperwork and accelerating approvals, online platforms enhance efficiency and improve the overall credit application experience for both businesses and lenders.

5.3 Customization Options

Business credit application forms can be tailored to meet specific business needs, allowing companies to request detailed information relevant to their industry. Customization options enable businesses to add or remove sections, such as financial statements, references, or industry-specific questions. Many templates and platforms offer drag-and-drop editors, making it easy to design a form that aligns with brand identity. Additionally, businesses can incorporate their logo, color schemes, and unique terms and conditions. Customization ensures the form is both professional and functional, providing a seamless experience for applicants while gathering essential data for credit decisions.

Best Practices for Creating a Credit Application Form

Ensure the form is clear, concise, and easy to understand. Include essential questions about business and financial details. Provide clear instructions and required fields. Use a professional design that reflects your brand and ensures security for sensitive information. Allow applicants to review and edit before submission. Make it mobile-friendly for convenience. Regularly update the form to comply with legal requirements and industry standards. Use digital tools for easier customization and integration with your systems. Train staff to handle applications efficiently and maintain confidentiality.

6.1 Clarity and Simplicity

A business-to-business credit application form should prioritize clarity and simplicity to ensure ease of understanding and completion. Avoid using complex jargon or unnecessary sections that may confuse applicants. Use clear headings, concise questions, and straightforward language to guide users through the process. Ensure the form is well-organized, with logical sections and minimal cognitive load. This approach reduces errors, saves time, and improves the overall user experience. Simplifying the form also helps businesses process applications more efficiently, leading to faster credit decisions and stronger B2B relationships. A clean design and intuitive layout further enhance the application process.

6.2 Essential Questions to Include

A business-to-business credit application form should include essential questions to gather critical information about the applicant. These questions should cover the business name, ownership details, financial history, and credit references. Additionally, inquire about the purpose of the credit request and the anticipated payment terms. Including questions about annual revenue, years in operation, and banking information is also crucial. These questions help assess the business’s creditworthiness and ensure a smooth evaluation process. Avoid unnecessary or overly intrusive questions to maintain a professional and respectful tone. The goal is to strike a balance between thoroughness and applicant convenience.

6.3 Compliance with Regulations

Ensuring compliance with regulations is critical when creating a business-to-business credit application form. The form must adhere to laws such as the Equal Credit Opportunity Act (ECOA) and the Fair Credit Reporting Act (FCRA), which govern how credit information is collected and used. Additionally, compliance with data protection regulations, such as GDPR, is essential to safeguard sensitive business and personal information. Clearly outlining terms and conditions and ensuring transparency in the credit process helps avoid legal disputes. Non-compliance can result in fines and reputational damage, making regulatory adherence a top priority for businesses. Always consult legal experts to ensure full compliance.

Managing Business Credit Lines

Managing business credit lines involves overseeing the credit extended to customers to ensure it aligns with their payment history and financial stability. Regularly monitoring credit usage and adjusting terms as needed helps maintain a healthy cash flow and customer trust.

7.1 Setting Credit Limits

Setting credit limits is a critical step in managing business credit lines. It involves evaluating a customer’s financial stability, payment history, and industry standing to determine the appropriate credit amount. By analyzing financial statements, credit scores, and references, businesses can establish limits that balance risk and customer needs. Clear credit limits help prevent over-extension of credit, ensuring timely payments and maintaining healthy cash flow. Regular reviews of credit limits are essential to adapt to changing customer circumstances and market conditions, fostering long-term financial stability and strong business relationships. This process ensures that credit terms align with both customer and supplier interests.

7.2 Monitoring Credit Usage

Monitoring credit usage is essential for maintaining healthy business relationships and financial stability. Businesses should regularly track how much credit customers are using to ensure it aligns with agreed-upon limits. This involves reviewing account balances, payment histories, and transaction patterns. Automated tools, such as accounting software, can help streamline this process by providing real-time insights. By closely monitoring credit usage, businesses can identify potential risks early, such as excessive borrowing or late payments, and take proactive measures to address them. This ensures sustainable credit extension and supports long-term customer partnerships while safeguarding the supplier’s financial interests. Regular reviews also help in making informed decisions about credit limit adjustments.

7.3 Adjusting Terms as Needed

Adjusting credit terms is crucial for maintaining flexibility in B2B relationships. Businesses may need to modify credit limits, payment terms, or interest rates based on a customer’s changing financial situation or market conditions. Regular reviews of credit agreements allow suppliers to assess whether existing terms remain appropriate. For instance, a customer with a proven track record of timely payments might qualify for higher credit limits or extended payment periods. Conversely, signs of financial distress may necessitate tighter terms to mitigate risk. Clear communication and documentation are essential when making adjustments to ensure both parties understand and agree to the new conditions. This adaptive approach fosters trust and long-term collaboration while protecting the supplier’s financial interests. Adjustments should always align with the supplier’s risk tolerance and business goals. Regular reviews ensure terms remain fair and sustainable for both parties. This proactive management helps prevent disputes and supports mutual growth. Adjusting terms as needed is a key aspect of effective credit management.

Maintaining a Positive Credit Relationship

Maintaining a positive credit relationship is built on trust, timely payments, and clear communication. Regular reviews ensure terms remain mutually beneficial, fostering long-term collaboration and financial stability.

8.1 Timely Payments

Timely payments are crucial for maintaining a positive credit relationship. Paying invoices on or before the due date demonstrates reliability and financial responsibility. This practice helps build trust with suppliers and financial institutions, fostering long-term collaboration. Late payments can damage credit scores and lead to penalties or strained relationships. Businesses should prioritize payment schedules and communicate proactively if challenges arise. Consistent on-time payments enhance credibility, making it easier to secure favorable credit terms in the future. This habit is essential for sustaining a healthy and mutually beneficial B2B credit relationship.

8.2 Clear Communication

Clear communication is vital for maintaining a positive credit relationship. Businesses should ensure transparency in discussing financial expectations, payment terms, and any changes in their operations. Open dialogue helps prevent misunderstandings and builds trust between parties. Regular updates on financial status or challenges demonstrate accountability and foster collaboration. Suppliers and lenders appreciate proactive communication, which can lead to more flexible terms or support during difficult periods. Effective communication strengthens partnerships and ensures a smooth credit relationship, benefiting both businesses involved. It also promotes mutual understanding and long-term success in B2B transactions.

8.3 Regular Reviews and Updates

Regular reviews and updates are essential for maintaining a healthy credit relationship. Businesses should periodically assess their financial health and update their credit information to reflect current standings. This includes reviewing financial statements, credit histories, and any changes in business operations. Updates ensure that credit terms remain appropriate and aligned with the business’s current needs. Regular reviews also help identify potential issues early, allowing for proactive adjustments. By keeping information up-to-date, businesses demonstrate accountability and commitment to their credit agreements. This practice fosters trust and supports long-term partnerships, ensuring a stable and mutually beneficial credit relationship.

Common Mistakes to Avoid

Common mistakes include submitting incomplete or inaccurate information, ignoring credit history, and failing to follow up after application submission. These errors can delay or deny credit approval.

9.1 Incomplete or Inaccurate Information

Submitting a business credit application form with incomplete or inaccurate information is a common mistake that can lead to delays or rejection. Lenders rely on the data provided to assess creditworthiness, so missing or incorrect details, such as financial statements, ownership information, or references, can raise concerns. Inaccuracies may also damage the business’s credibility. It is crucial to ensure all fields are filled out thoroughly and truthfully. Double-checking the application for completeness and accuracy before submission is essential to avoid complications and ensure a smooth review process.

9.2 Ignoring Credit History

Ignoring or omitting credit history in a business credit application form is a critical error. Credit history provides insight into a company’s financial reliability and repayment habits. Lenders use this information to assess risk and determine creditworthiness. Failing to disclose or downplay negative credit history can lead to rejection or unfavorable terms. Businesses should ensure their credit history is accurate and up-to-date. Addressing past issues or explaining discrepancies can demonstrate responsibility and improve credibility. Ignoring credit history not only delays the process but also undermines trust, making it harder to secure credit approvals.

9.3 Poor Follow-Up

Poor follow-up is a common mistake that can hinder the approval of a business credit application. After submitting the form, businesses must actively monitor the process and maintain communication with the lender or supplier. Failing to respond to requests for additional information or clarification can lead to delays or rejection. Regular follow-up demonstrates professionalism and commitment, ensuring the application remains a priority. Neglecting this step can damage relationships and credibility, making it harder to secure credit in the future. Timely and consistent communication is essential to streamline the approval process and build trust with financial partners.

Legal Considerations

Legal considerations are crucial when creating a business credit application form. Ensure compliance with credit laws, include clear terms and conditions, and protect customer data privacy to avoid legal issues.

10.1 Terms and Conditions

Clearly outlining terms and conditions in a business credit application form is essential for establishing a legal framework. These terms should specify payment timelines, invoice dispute procedures, and credit agreement details. They must be transparent and legally binding to protect both parties. Including clauses about late payment penalties, interest rates, and dispute resolution ensures clarity. Businesses should consult legal experts to draft these terms, ensuring compliance with local laws. Properly structured terms and conditions help prevent misunderstandings and provide a clear roadmap for the credit relationship, safeguarding both the supplier and the customer’s interests. They are fundamental to a smooth B2B credit process.

10.2 Compliance with Credit Laws

Ensuring compliance with credit laws is critical when processing a business credit application form. Businesses must adhere to regulations like the Equal Credit Opportunity Act (ECOA), which prohibits discrimination based on race, gender, or other factors. Credit laws also require transparency in terms and conditions, ensuring applicants are fully informed. Proper compliance involves verifying the accuracy of information and maintaining privacy standards. Failure to comply can result in legal penalties and reputational damage. Businesses should regularly review and update their credit application processes to align with evolving credit laws and regulations, ensuring fairness and legality in all transactions.

10.3 Privacy and Data Protection

Privacy and data protection are paramount when handling business credit application forms. Businesses must ensure that sensitive information, such as financial data and personal details, is securely stored and processed. Compliance with regulations like the General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA) is essential. Encrypting data, implementing access controls, and training staff on privacy practices are critical measures. Applicants should be informed about how their data will be used, shared, and retained. Breaches can lead to severe penalties and loss of trust, making robust data protection practices indispensable for maintaining credibility and legal compliance in B2B credit transactions.

The Future of Business Credit Applications

The future of business credit applications is shaped by digital transformation, with advancements in AI integration and automation streamlining processes. Enhanced security measures and blockchain technology will ensure safer, more efficient transactions, revolutionizing B2B credit systems.

11.1 Digital Transformation

Digital transformation is revolutionizing business credit applications, shifting from traditional paper-based forms to online platforms. Automation and AI integration streamline processes, enabling faster and more accurate credit decisions. Enhanced security measures, such as blockchain, protect sensitive data, ensuring compliance with regulations. Real-time data analysis and machine learning improve risk assessment, reducing errors. Customizable templates and mobile-friendly interfaces enhance user experience, making it easier for businesses to apply for credit. This shift not only increases efficiency but also strengthens relationships between businesses and financial institutions, fostering trust and transparency in B2B transactions.

11.2 Automation and AI Integration

Automation and AI integration are transforming business credit applications, enabling faster and more accurate processing. AI-powered systems analyze financial data, credit histories, and risk factors to make informed decisions. Automated workflows reduce manual effort, minimizing errors and speeding up approvals. Machine learning algorithms identify patterns, predicting creditworthiness and detecting fraud. AI-driven chatbots assist applicants, improving user experience. These technologies enhance efficiency, scalability, and decision-making accuracy, making B2B credit applications more streamlined and accessible. As AI evolves, it will continue to play a pivotal role in modernizing credit application processes, ensuring better outcomes for businesses and lenders alike.

11.3 Enhanced Security Measures

Enhanced security measures are critical in modern business credit applications to protect sensitive data. Advanced encryption technologies safeguard personal and financial information, ensuring confidentiality. Secure databases and access controls prevent unauthorized breaches. Compliance with regulations like GDPR and CCPA is essential to maintain trust. Regular audits and penetration testing identify vulnerabilities, strengthening system integrity. Multi-factor authentication and role-based access further secure the process. These measures not only protect businesses but also build credibility with customers, ensuring a safe and reliable credit application experience in an increasingly digital landscape.